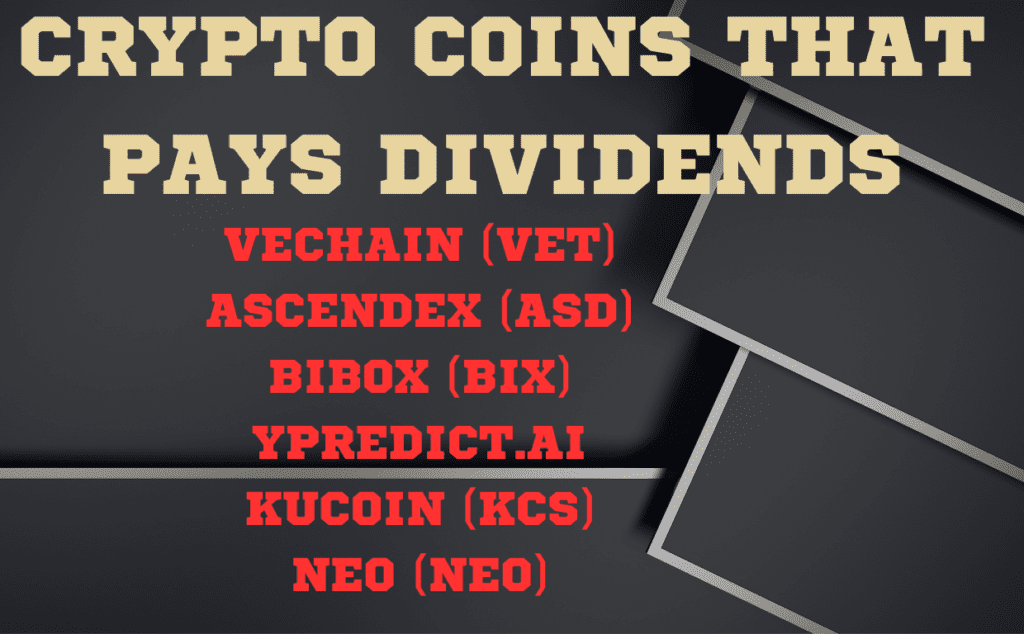

Are you looking to invest in cryptocurrencies that offer more than investment returns gains along with Dividend. Here I have explained 6 Crypto Coins That Pay Dividends.

Cryptocurrency coins do not technically give dividends in the same way that stocks do. Stocks are shares of ownership in a company, and dividends are a share of the company’s profits that are paid out to shareholders. Cryptocurrency coins are not shares of ownership in a company, so they cannot technically pay dividends

However, there are some cryptocurrencies that distribute rewards to holders in a way that is similar to dividends. These rewards can be paid out in the form of new coins, transaction fees, or other benefits.

Here are some of the ways that cryptocurrencies can pay dividends

Staking: Staking is the process of locking up your cryptocurrency coins in order to support the network. In return for staking your coins, you can earn rewards, which can be paid out in the form of new coins or transaction fees.

Proof-of-stake (PoS) coins: PoS coins are cryptocurrencies that use staking to validate transactions. The more coins you stake, the more likely you are to be chosen to validate a transaction and earn rewards.

Masternodes: Masternodes are servers that provide services to the cryptocurrency network. In return for running a masternode, you can earn rewards, which can be paid out in the form of new coins or transaction fees.

Airdrops: Airdrops are a way for cryptocurrency projects to distribute their coins to the public. Airdrops are often done as a way to promote a new coin or to reward early adopters.

The rewards that you earn from holding cryptocurrencies can be a way to generate passive income. However, it is important to remember that cryptocurrencies are a volatile asset, and the value of your rewards can go up or down depending on the market conditions.

Tezos (XTZ): Tezos is a PoS cryptocurrency that rewards stakers with new coins.

Cosmos (ATOM): Cosmos is a PoS cryptocurrency that rewards stakers with new coins and transaction fees.

Staking Rewards (SCRT): Staking Rewards is a PoS cryptocurrency that rewards stakers with new coins and transaction fees.

Dash (DASH): Dash is a PoS cryptocurrency that rewards masternodes with transaction fees.

Steem (STEEM): Steem is a PoS cryptocurrency that rewards users with new coins and transaction fees for creating and curating content.

Here I will give in- depth information on below crypto coin that gives dividend.

- VeChain (VET)

- AscendEX (ASD)

- Bibox (BIX)

- YPredict

- KuCoin (KCS)

- NEO (NEO)

VeChain-VET: Crypto Coins that pay Dividends

VeChain is advance blockchain platform that focuses on supply chain management method. VET holders are rewarded with VeThor tokens, which are used to power transactions on the VeChain network. The amount of VeThor that VET holders receive is proportional to the number of VET tokens they hold.

VeThor tokens are generated every second, and the amount of VeThor generated is determined by the amount of data that is being processed on the VeChain network. VET holders can claim their VeThor tokens by staking their VET tokens on a VeChain node.

The frequency of VeThor payments depends on the VeChain node that you are staking your tokens with.

These are just a few of the cryptocurrencies that pay dividends. There are many other cryptocurrencies that offer this type of reward, and the landscape is constantly changing. It is important to do your own research before investing in any cryptocurrency, including those that pay dividends.

VeChain is a blockchain based platform that uses distributed ledger technology to provide solutions for supply chain management. It was founded in year 2015 by Sunny Lu. The former CIO of Louis Vuitton China continent. VeChain is diversified headquartered in Singapore and has offices in China, Europe and United States.

The VeChain token (VET) is used to power the VeChainThor blockchain. VET holders can stake their tokens to earn VeThor (VTHO), which is used to pay for transaction fees on the VeChain network.

VeChain has partnered with a number of major companies, including Walmart China, BMW, and DNV GL. These partnerships have helped VeChain to become one of the leading blockchain platforms for supply chain management.

In 2015, VeChain was founded as a private blockchain project called VeChain 1.0. In 2017, VeChain 1.0 was rebranded as VeChain 2.0 and transitioned to a public blockchain. In 2018, VeChain 2.0 was renamed to VeChainThor.

VeChainThor is a Proof-of-Authority (PoA) blockchain, which means that the nodes on the network are authorized by a set of trusted validators. This makes VeChainThor more scalable and secure than other blockchain platforms.

VeChainThor uses a two-token system: VET and VTHO. VET is the main token that is used to power the network. VTHO Coin is used to pay for transaction fees on platform network.

VeChain has a number of features that make it a promising blockchain platform for supply chain management.

Crypto Coins that Pays Dividends as these features include:

Transparency: VeChainThor uses a distributed ledger to record all transactions on the network. This makes it possible to track the movement of goods and materials in real time.

Security: VeChainThor uses a PoA consensus mechanism, which makes it more secure than other blockchain platforms.

Scalability: VeChainThor is designed to be scalable, so it can handle a large number of transactions.

Compliance: VeChainThor is compliant with a number of regulations, making it a good choice for businesses that need to track the movement of goods and materials across borders.

VeChain has a number of partnerships with major companies, including Walmart China, BMW, and DNV GL. These partnerships have helped VeChain to become one of the leading blockchain platforms for supply chain management.

VeChain is a promising blockchain platform with a number of features that make it a good choice for supply chain management. It has a number of partnerships with major companies and is backed by a strong team of developers.

Here are some of the key milestones in the history of VeChain:

2015: VeChain is founded as a private blockchain project called VeChain 1.0.

2017: VeChain 1.0 is rebranded as VeChain 2.0 and transitions to a public blockchain.

2018: VeChain 2.0 is renamed to VeChainThor.

2019: VeChain partners with Walmart China to track the food supply chain.

2020: VeChain partners with BMW to track the supply chain of luxury cars.

2021: VeChain partners with DNV GL to track the supply chain of food and beverages.

2022: VeChain continues to grow its partnerships and expand its use cases.

AscendEX-ASD:

AscendEX (ASD) is the native token of the AscendEX cryptocurrency exchange. It was launched in 2018, originally under the name BitMax.io. The token is used to pay for trading fees on the exchange, as well as for staking and other platform features.

ASD has a total supply of 1 billion tokens, but this has been reduced through a process called “burning.” Burning is when tokens are permanently removed from circulation. In the case of ASD, burning occurs when tokens are used to pay for trading fees. For every 100 ASD used in trading fees, 50 ASD are burned.

This burning mechanism is designed to reduce the supply of ASD over time, which can help to increase the value of the token. It also helps to ensure that the exchange is sustainable in the long term.

ASD holders can earn dividends by staking their tokens. Staking is a process of locking up tokens in order to support the security of a blockchain network. In return for staking their tokens, users are rewarded with a portion of the transaction fees generated by the network.

The amount of dividends that ASD holders earn is determined by the amount of tokens they stake and the length of time they stake them for. The exchange also offers a loyalty program that rewards users with additional dividends for staking their tokens for longer periods of time.

In addition to paying dividends, ASD holders can also use their tokens to participate in platform governance. The exchange has a DAO (decentralized autonomous organization) that is governed by ASD holders. This means that ASD holders have a say in how the exchange is run.

Overall, ASD is a utility token that is used to power the AscendEX cryptocurrency exchange. It has a number of features that make it attractive to investors, including its burning mechanism, staking rewards, and platform governance.

Here is a brief history of AscendEX (ASD):

2018: AscendEX (then known as BitMax.io) is founded.

2019: The ASD token is launched.

2020: The exchange begins burning ASD tokens.

2021: The exchange rebrands to AscendEX.

2022: The exchange introduces a loyalty program for ASD holders.

Bibox-BIX:

Bibox is a cryptocurrency exchange that offers its own token, BIX. BIX holders receive a share of the exchange’s profits, as well as other benefits such as discounted trading fees.

The amount of BIX dividends that a user receives is determined by the number of BIX tokens they hold. Bibox pays dividends quarterly, and the amount of dividends paid out each quarter is determined by the exchange’s profits.

Bibox is a cryptocurrency Exchange Platfrom was founded in the year 2017. It is headquartered in Singapore and has over 3 million users worldwide. Bibox offers a wide variety of cryptocurrencies and trading pairs, as well as margin trading, futures trading, and staking.

The Bibox token (BIX) is a utility token that is used to power the Bibox ecosystem. BIX holders can receive a share of the exchange’s profits, as well as other benefits such as reduced trading fees and access to airdrops.

The BIX token was launched in September 2017 and was initially priced at $0.02. The price of BIX has fluctuated significantly since then, reaching a high of $0.20 in January 2018 and a low of $0.005 in December 2018.

As of August 2023, the price of BIX is $0.06. The total supply of BIX is 1 billion, and there is no planned buyback or burn.

Here are some of the key milestones in the history of Bibox:

2017: Bibox is founded in Singapore.

2017: The Bibox token (BIX) is launched.

2018: Bibox raises $10 million in a funding round led by Sequoia Capital China.

2019: Bibox becomes one of the top 10 cryptocurrency exchanges by trading volume.

2020: Bibox launches a decentralized exchange (DEX).

2021: Bibox expands its offerings to include margin trading, futures trading, and staking.

2022: Bibox becomes one of the top 5 cryptocurrency exchanges by trading volume.

Bibox is a rapidly growing cryptocurrency exchange with a bright future. It is well-positioned to become a leading platform for cryptocurrency trading and investment.

Here are some of the benefits of holding Bibox token (BIX):

Profit sharing: BIX holders receive a share of the exchange’s profits every quarter.

Reduced trading fees: BIX holders enjoy reduced trading fees on the Bibox exchange.

Access to airdrops: BIX holders are eligible to receive airdrops of new cryptocurrencies that are listed on the Bibox exchange.

Staking: BIX holders can stake their tokens to earn rewards.

Voting rights: BIX holders have voting rights on important decisions that affect the Bibox exchange.

If you are interested in investing in Bibox token, As Crypto coins that pays Dividends. I recommend doing your own research to understand the risks and potential rewards.

YPredict:

yPredict is a DeFi protocol that rewards investors holding yPred tokens in Protocol platform. The protocol uses a combination of machine learning and artificial intelligence to predict the prices of financial assets. If the predictions are correct, yPredict generates profits, which are then distributed to yPred token holders.

The amount of dividends that yPred token holders receive is determined by a number of factors, including the number of yPred tokens they hold, the accuracy of the predictions, and the overall performance of the protocol. yPredict.ai has not yet released any information about the frequency of dividend payments.

The yPredict token (YPRED) was launched in 2022. The presale for the token was held in January 2022 and raised over $1.4 million. The token was listed on a number of exchanges in March 2022.

yPredict is still a relatively new project, but it has the potential to be a major player in the DeFi space. The team behind the project has a strong background in machine learning and artificial intelligence, and they have a clear vision for how yPredict can be used to improve the financial markets.

Here are some of the key milestones in the history of yPredict:

2022: yPredict is founded.

2022: The yPredict token (YPRED) is launched.

2022: The presale for YPRED is held and raises over $1.4 million.

2022: YPRED is listed on a number of exchanges.

2023: yPredict releases its first alpha version.

2023: yPredict partners with a major financial institution.

Here are some of the risks associated with investing in yPredict:

The project is still in its early stages: yPredict is a relatively new project, and it is still under development. There is a risk that the project may not be successful or may not live up to its promises.

The token price is volatile: The price of YPRED has been volatile since its launch. There is a risk that the price could go down as well as up.

The project could be subject to regulation: yPredict is a financial technology project, and it could be subject to regulation in the future. This could impact the project’s ability to operate and could also affect the value of the YPRED token.

KuCoin-KCS:

KuCoin is another cryptocurrency exchange that offers its own token, KCS. KCS holders receive a share of the exchange’s profits, as well as other benefits such as reduced trading fees and access to airdrops.

The amount of KCS dividends that a user receives is determined by the number of KCS tokens they hold. KuCoin pays dividends monthly, and the amount of dividends paid out each month is determined by the exchange’s profits.

KuCoin is a cryptocurrency exchange was founded in the year of 2017. It is headquartered in Seychelles and has over 10 million users worldwide. KuCoin offers a wide variety of cryptocurrencies and trading pairs, as well as margin trading, futures trading, and staking.

The KuCoin token (KCS) is a utility token that is used to power the KuCoin ecosystem. KCS holders can receive a share of the exchange’s profits, as well as other benefits such as reduced trading fees and access to airdrops.

The KCS token was launched in September 2017 and was initially priced at $0.04. The price of KCS has fluctuated significantly since then, reaching a high of $4.50 in January 2018 and a low of $0.03 in December 2018.

As of August 2023, the price of KCS is $1.40. The total supply of KCS is 200 million, and there is a planned buyback and burn until just 100 million KCS remain.

Here are the history of KuCoin:

2017: KuCoin is founded in Seychelles.

2017: The KuCoin token (KCS) is launched.

2018: KuCoin raises $20 million in a funding round led by IDG Capital.

2019: KuCoin becomes one of the top 10 cryptocurrency exchanges by trading volume.

2020: KuCoin launches a decentralized exchange (DEX).

2021: KuCoin expands its offerings to include margin trading, futures trading, and staking.

2022: KuCoin becomes one of the top 5 cryptocurrency exchanges by trading volume.

KuCoin is a rapidly growing cryptocurrency exchange with a bright future. It is well-positioned to become a leading platform for cryptocurrency trading and investment.

KuCoin token (KCS): Here are some of the benefits of Token holding

Profit sharing: KCS holders receive a share of the exchange’s profits every month.

Reduced trading fees: KCS holders enjoy reduced trading fees on the KuCoin exchange.

Access to airdrops: KCS holders are eligible to receive airdrops of new cryptocurrencies that are listed on the KuCoin exchange.

Staking: KCS holders can stake their tokens to earn rewards.

Voting rights: KCS holders have voting rights on important decisions that affect the KuCoin exchange.

If you are interested in investing in KuCoin token, Crypto coins that pays Dividends. I recommend doing your own research to understand the risks and potential rewards.

NEO is a Advance Blockachain Platform that supports smart contracts and dApps. NEO holders are rewarded with GAS tokens, which are used to pay for transaction fees on the network. The amount of GAS that NEO holders receive is proportional to the number of NEO tokens they hold.

GAS tokens are generated every 15 seconds, and the amount of GAS generated is determined by the number of NEO tokens that are staked. Staking is the process of locking up your NEO tokens in order to participate in the network’s consensus mechanism.

NEO holders can claim their GAS tokens by staking their NEO tokens on a NEO node. The frequency of GAS payments depends on the NEO node that you are staking your tokens with.

NEO, formerly known as Antshares, is a blockchain platform that supports smart contracts and dApps. It was founded in the year 2014 by famous Chinese person Da Hongfei and Erik Zhang. NEO is headquartered in Singapore and has offices in China, Europe, and the United States.

The NEO token (NEO) is used to power the NEO blockchain. NEO holders can stake their tokens to earn GAS tokens, which are used to pay for transaction fees on the NEO network.

NEO has been called the “Chinese Ethereum” because it is very much similar to Ethereum in comparison on many ways. However, NEO developers has given some more unique features that set it apart from Ethereum. For example, NEO uses a delegated Byzantine Fault Tolerance (dBFT) consensus mechanism, which is more scalable and secure than Ethereum’s Proof-of-Work (PoW) consensus mechanism.

NEO has also been involved in a number of partnerships with major companies, such as Onchain, Alibaba, and Tencent. These partnerships have helped NEO to gain traction in the Chinese market.

Here are some of the key milestones in the history of NEO:

2014: NEO is founded as Antshares.

2015: NEO raises $34 million in an ICO.

2017: NEO rebrands to NEO.

2018: NEO launches the NEO Council, a group of 21 nodes that are responsible for securing the NEO blockchain.

2019: NEO partners with Onchain to develop the Ontology blockchain.

2020: NEO partners with Alibaba to develop a blockchain-based supply chain solution.

2021: NEO partners with Tencent to develop a blockchain-based gaming platform.

NEO is a rapidly growing blockchain platform with a bright future. It is well-positioned to become a leading platform for smart contracts and dApps in China and beyond.

Here are some of the benefits of holding NEO:

Staking: NEO holders can stake their tokens to earn GAS tokens.

Smart contracts: NEO supports the creation of smart contracts, which are self-executing contracts that can be used to automate a variety of tasks.

dApps: NEO can be used to develop dApps, which are decentralized applications that run on the blockchain.

Scalability: NEO is designed to be scalable, so it can handle a large number of transactions.

Security: NEO uses a dBFT consensus mechanism, which is more scalable and secure than PoW consensus mechanisms.

Here are some of the challenges that NEO faces:

Competition: NEO faces competition from other blockchain platforms, such as Ethereum and EOS.

Regulation: NEO is still subject to regulation in China, which could limit its growth.

Technical issues: NEO has experienced some technical issues in the past, which could damage its reputation.