This Article is divided into 4 parts where I’m going discuss about how to read CandleStick Patterns for Day Trading. In Candlestick Chart totally 24 Pattern should have knowledge for all investors to do day trading. If you are investor doing trading without looking at price charts then. You should assuming self once, you’re trading without seeing cost diagrams. You are just simply shooting in obscurity. Price and Volume are the two most significant contributions for specialized examination. They structure the premise of all specialized investigation. Chart diagrams help to break down price and volume information in visual structure.

A Candle Stick outline is the most well known type of chart diagram utilized by brokers. In a candle outline, the cost diagram is addressed as a progression of candles, subsequently it is known as a candle chart graph.

Candle stick passes on valuable data like the trend pattern, bullish/bearish, volume at a straightforward look. The chart is digram comprised of red and green candles. Where each Candle flame gives data about opening, closing and high of trading price inside a specific time frame.

Candle stick outline model Regardless of whether you are not a merchant but rather a drawn out stock financial backer you ought to know about the candle graphs. Since no news or other web sources will give you more helpful data about a stock than its cost graph.

You can figure out the pattern of a specific stock and furthermore track down a suitable entry point and also exit point by perusing candle diagrams.

What are Candlestick Chart Patterns

Every Candlestick charts are live market are formed of red and green candles. Each candle represents its range of prices going up/down during a particular time period. Chart form a different pattern bullish/bearish in a time frame of 5-min candlestick chart, might be each candlestick represents a 10 min period. Also if you interested in long time frame of 15 min candlestick chart, each candlestick represents it’s High Price, low and closing Price.

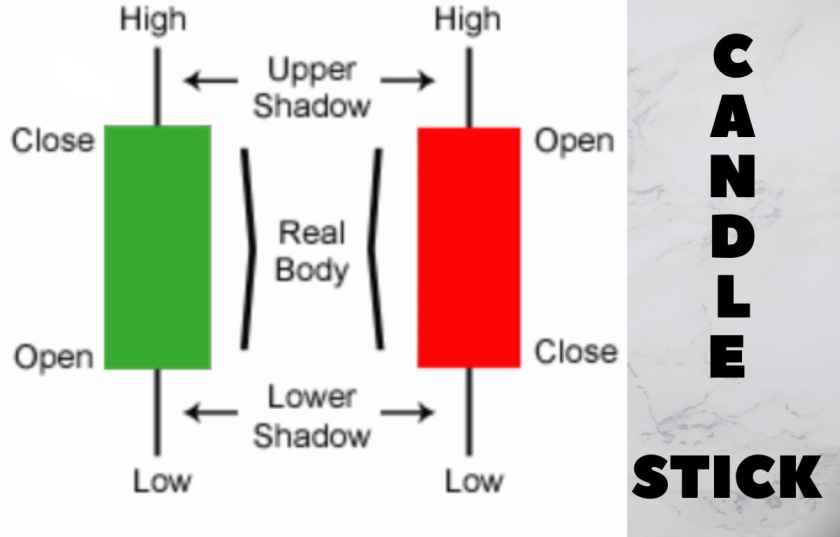

Candle Body : The highlighted portion in image below (green or red) is the body of the candle which denotes represent the opening price and closing price. The lower end on image below of the body is the closing price with a red candle and the upper end of the body is the opening price.

Similarly, check on below image the lower end of the body in a Green Candle Pattern is the opening price and the upper end of the body is to consider the closing price.

Candlewick: The upper shadow and the lower shadow represent in below image the wick of the candle. The wick of the candle denotes as the range of prices at which the stock price has traded in that time duration.

How to Analyse CandleStick Chart pattern for Day Trading

Candlestick Chart represent it’s having a look on Green CandleStick Pattern and Red CandleStick Pattern.

“Green CandleStick” represent with price on it’s closing price at the end of the time periods 5/10/15 Mins is higher than the opening price. The Candle will give only Green doesn’t mean it’s Bullish and market will go up from here. Few Things to be considered along with Green CandleStick to finalize it’s Bullish or Bearish. We will discuss in-depth how to know in detail by following below steps.

Frist thing to select For day trading is Time frame 5/10/15 Mins On each Mins it will form a candle with Green or Red. Next you need to check it’s opening price, closing price, lowest price and highest price.

Second thing to wait for Form other Candle as you selected time frame. It’s might be Green CandleStick or Red CandleStick. You should look for both candle previous and current candle to know market trend is bullish/bearish.

Third thing to consider check both candle previous and current candle opening price, closing price, lowest price and highest price. If previous candle closing price is 10 $, Opening Price is 7$, lowest price 5$, higest price is 12$.

Fourth step check Current candle Closing price. If it’s closing price is higer then previous candle. You might thing along with volume. Market is on bullish, buyer closing the candle on higher price then previous. Color if candles stick doesn’t matter, it’s all about price to know market is up trend or down, price is key factor for day trading along with volume.

Fifth step current CandleStick is Red, thing to consider before taking day trading.

“Red CandleStick” assuming current candle from a red. It represent red candle that the closing price is 14$ at the end of the time period is lower price is is 6$ than the opening price 10$ with Red color CandleStick. We can’t just come into final decision to know buy or sell here by just seeing Red candle here.

Example: Current Candle Opening with Price 10$, lowest price 6$, highest price 16$, Closing price is 14$. It’s a Bullish CandleStick.

Sixth step to wait for Form a new Candlestick and check it’s closing price with previous both candle. If it’s closing at higher price then both closing price. Volume and Price taken Market up. It gives 70-80% confirm the trend of market is bullish. If Candle is Red or Green doesn’t matter closing price to be considered. To take market up or down to go with buying or selling.

Table of Contents

6 Candlestick Patterns to Learn for Intraday Trading

There are many candlestick chart patterns, here in this article I will discuss with 6 Candlestick of total 24 CandleStick Pattern. This 24 CandleStick Pattern are most trader or investors implement for day trading. I will make more depth information on this 24 CandleStick Pattern by dividing 4 part explaining them.

1. Hammer CandleStick Pattern

2. Inverted Hammer CandleStick Pattern

3. Shooting Star CandleStick Pattern

4. Hanging Man CandleStick Pattern

5. Spinning Top CandleStick Pattern

•Bullish Spinning top

•Barerish Spinning top

6. Doji CandleStick Pattern

•Dragonfly Doji

•Gravestone Doj

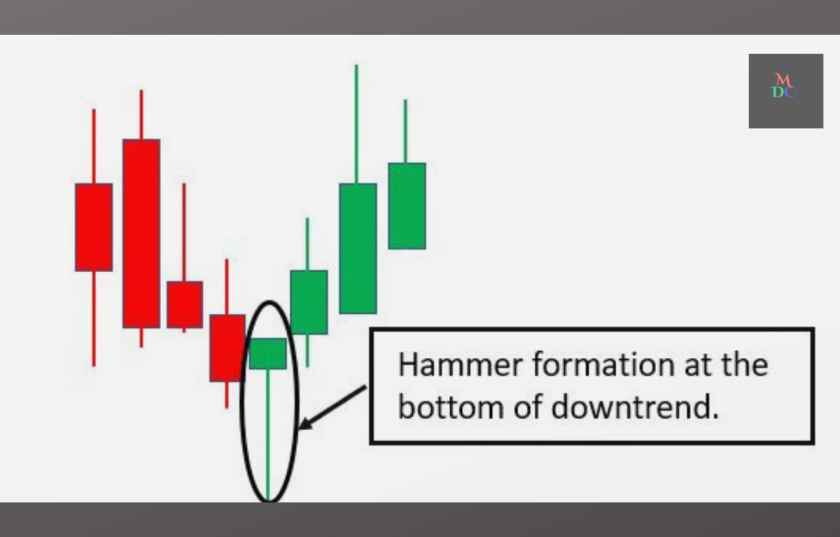

Hammer CandleStick Pattern

A Hammer CandleStick is a bullish signal, consisting of a short upper body either With Green or Red Body and longer lower wick. It indicates that the prices bounced back from longer lower wick even after selling pressure. When any Stock price is moving down trend and at a support point a Hammer CandleStick bounce back. Then next CandleStick must be any candle that closing higher then Hammer at a downtrend indicates that the trend has changed to bullish.

Then You can go for Buying, hammer CandleStick can be both red or green color are bullish indicators but green hammers are high probability more stronger. This candle is a bullish indicators on down trend or Support point. It gives a clear picture of a trend reversely that the buyers are gaining control.

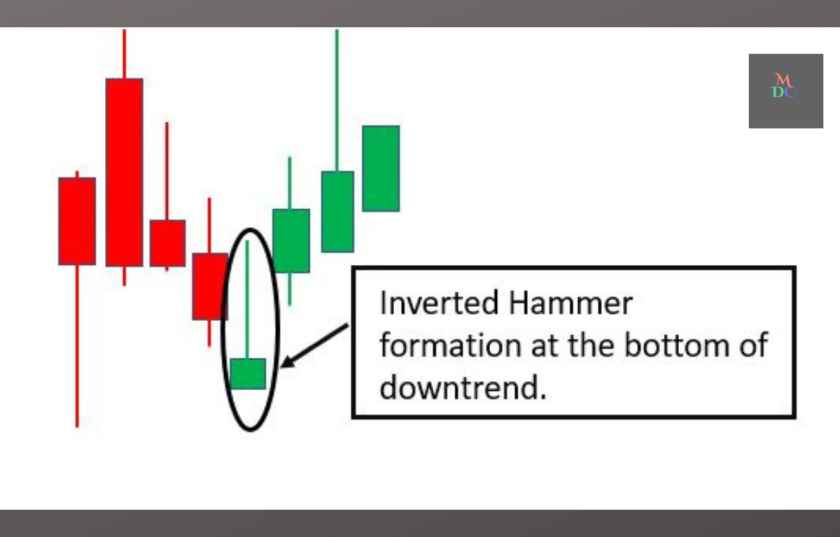

Inverted Hammer CandleStick Pattern

An Inverted Hammer CandleStick is signal of Buyers are controly at a support point to reverse up trend. When any Stock price moving down and at the bottom of a downtrend a Inverted Hammer CandleStick form it’s a bullish trend reversal signal. It indicates on that candle the buyers were able to resist selling pressure but sellers were not able to take price on down much.

When stock price continuously falling down trend with red candle and at support point Inverted Hammer CandleStick should form. It can be Green or Red color. But After inverted candle, If there is next a green candlestick and closing price is higher then inverted Hammer. It would give more further confirmation of a trend reversal.

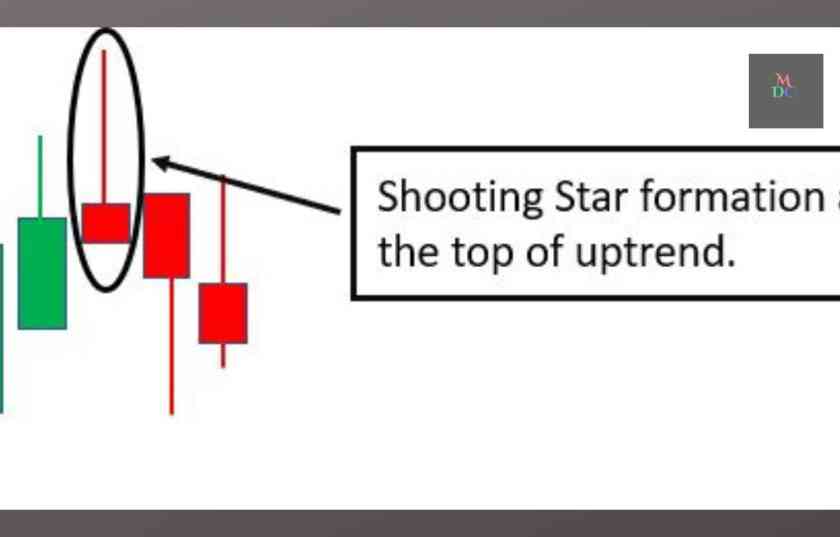

Shooting Star CandleStick Pattern

The Inverted Hammer formation at resistance point on up trend. When Stock price continuously on up trend with green candlestick at the top. At Resistance Point of uptrend with green or red Inverted Hammer CandleStick is called a Shooting Star Candle. It is a Seller bearish trend reversal signal. If Shooting Star is having Red color it’s more stronger. The Candle long upper wick indicates that buyers were not able to take prices up, here sellers are gaining control on buyer’s.

For more stronger confirmation note this. Shooting Star can be red or green, but if there is a Red CandleStick before next to the shooting star. It would give more stronger confirmation further of a trend reversal.

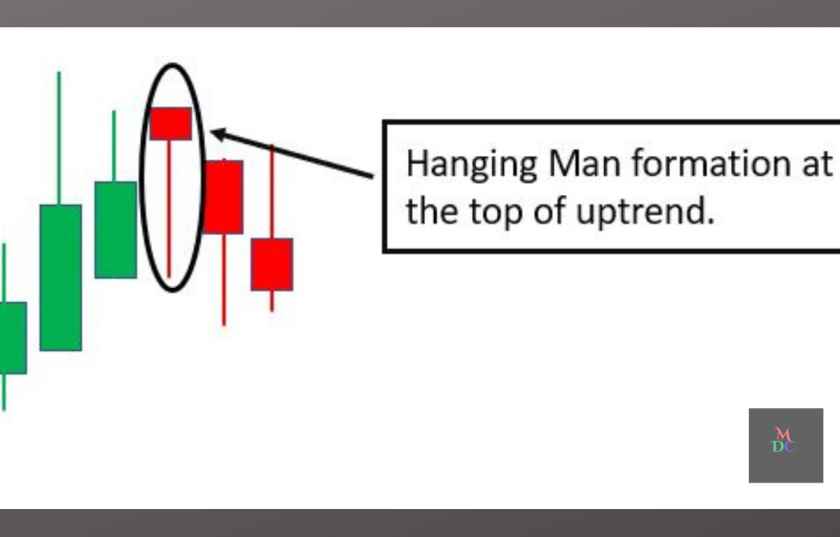

Hanging Man CandleStick Pattern

When stock price is up trend moving then, a Hammer formation at the top resistance point of an uptrend is called Hanging Man CandleStick. This is a bearish signal indicating at resistance point the end of the uptrend. The candle with long lower wick indicates that the buyers have tried to keep the prices up but the sellers are gaining more control then buyer’s.

As you can see in the below an adjoining image, there is a uptrend with green color then downtrend reversal after the hanging man formation.

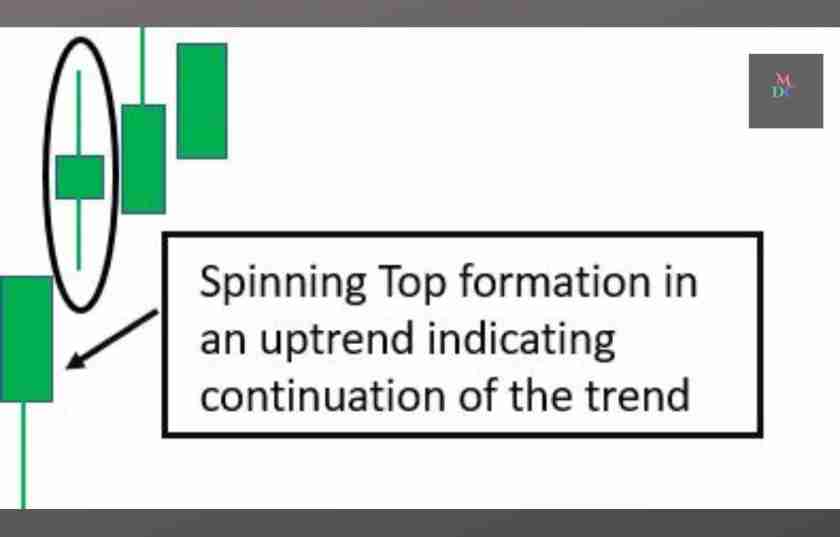

Spinning Top CandleStick Pattern

A Spinning Top CandleStick Pattern is indicated by a short body candle in the middle with a long upper and lower wick. This CandleStick indicates that neither the buyer’s or seller’s couldn’t gain control. Hence, Spinning Top the opening price and closing price were close to each other.

A Spinning Top shows investors and traders have indecision and it’s might be a neutral candlestick indicating a sideways or range bound in the trend or a continuation.

Bullish Spinning top

A Bullish Spinning Top at the bottom of a downtrend at Support point could indicate a potential trend reversal. If there is a Spinning Top CandleStick after a continuous downtrend and the candle after the spinning top at support point is a green candle, it may be a sign for the stock of trend reversal.

Bearish Spinning top

A Bearish Spinning Top at the top of an uptrend at resistance point could indicate a potential trend reversal. If there is a spinning top CandleStick after a continuous uptrend at resistance point and the candle after the spinning top is a red candle, it may be a sign of trend reversal for the stock.

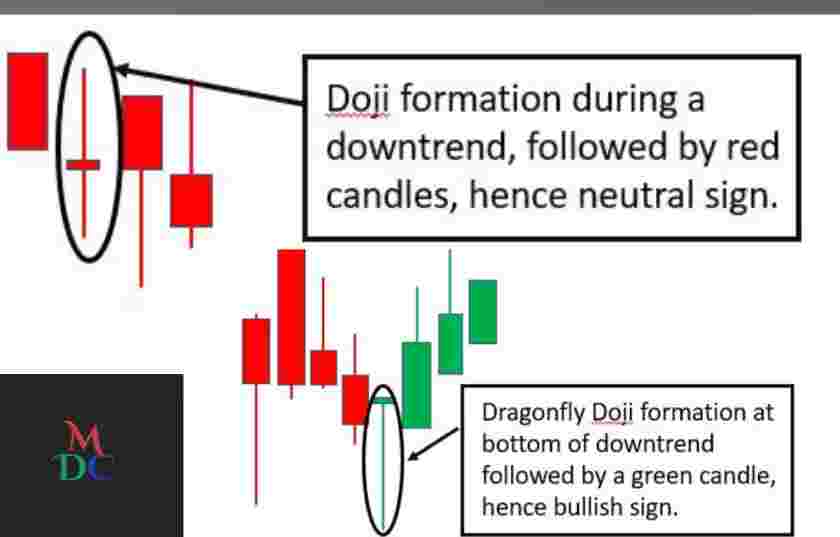

Doji Candlestick Pattern

The Doji Candlestick Pattern is formation when the opening Price and closing price of a CandleStick is almost the same. Hence, the Doji candle looks like a ‘+’ sign. The Doji color might be a red or green candle, which representing indecision by Buyers and Sellers in the market. Doji candlestick i.e. neither the buyers or sellers are in control in day trading.

A Doji formation at the top or bottom of a trend at support and resistance point generally indicates a trend reversal. To better understand check below image. Each green CandleStick is clearly showing that buyer’s are taking the price more higher.

But then there is a Doji candle, where the buyer’s have been unable to take stock price higher like in the previous green candles. Which indicate signals that the seller’s have come into the action. Hence, Stock prices have come down following this Doji candle.

A Doji can also sometimes be a neutral sign indicating Sideways or Range Bound or pullback in a trending market.

Dragonfly Doji

A dragonfly candle doji looks like a ‘T’ sign. The dragonfly doji Candlestick at the bottom of a downtrend would mean that price may gain strength in the next few time frame.

It indicates that the seller’s tried to push the stock prices lower, but couldn’t do so because of the strong buyers’ strength.

Gravestone Doji

A Gravestone dragonfly doji Candlestick looks like an ‘Inverted T’ sign. The gravestone doji at the top of an uptrend would mean that the price may weaken in the next few time frame.

It indicates that the buyers tried to push the prices upwards, but could not do so because of the seller’s more strength.

The Bottom Line Of Content:

Stock Market is heavy risk market. Before you starting invest consult your financial advisor and read more articles about candlestick.

Frequently Asked Questions (FAQ)

A candlestick chart pattern is a visual representation of price movements in financial markets. It consists of individual “candles” that provide information about an asset’s open, high, low, and close prices over a specific time period. These patterns help traders and analysts make decisions based on price trends and potential reversals.

Some common candlestick patterns include Doji candle, Hammer CandleStick, Shooting Star Candle, Engulfing candle, and Harami candle. Doji signifies indecision, Hammer and Shooting Star indicate potential reversals, Engulfing suggests a strong reversal, and Harami can signal a trend change.

Candlestick patterns can be used for various purposes, such as identifying trend reversals, entry and exit points, and assessing market sentiment. Traders often use them in combination with other technical analysis tools to make informed decisions about buying or selling assets.

Candlestick patterns are widely applicable and can be used in various financial markets, including stocks, forex, commodities, and cryptocurrencies. However, their effectiveness may vary depending on market conditions and the timeframes you are trading or investing in.

Limitations of CandleStick Pattern include the potential for false signals, especially in volatile markets, and the need for additional analysis and risk management strategies. It’s essential to use candlestick patterns as part of a comprehensive trading or investment approach.