What Is a Pin Bar Candlestick?

A “Pin Bar” Candle Stick, or “pinocchio bar,” is a significant candlestick pattern in technical analysis, widely employed by traders to identify potential shifts in market trends or indications of ongoing price movements.This pattern plays a vital role in candlestick chart analysis as it offers valuable information about market sentiment and potential future price actions.

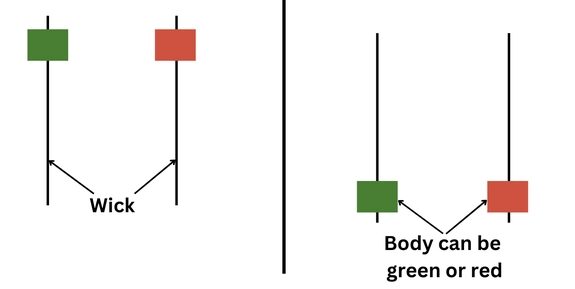

A pin bar features a single candlestick with a small or no body and a long tail or wick, which extends well beyond the surrounding price action. The color of the candle isn’t as crucial as its shape and location in relation to the surrounding price bars. It often emerges at key support or resistance levels or following substantial price movements.

A bullish pin bar, occurring at support, suggests a potential trend reversal to the upside, while a bearish pin bar at resistance hints at a possible downtrend reversal. Pin bars can also signal the continuation of existing trends, making them essential tools for traders. They reflect market sentiment, showcasing the struggle between buyers and sellers and the potential outcome for future price movements. However, they are most effective when used alongside other technical analysis tools and risk management strategies to make well-informed trading decisions.

A Pin Bar consists of three essential components:

Small Body: The body of a Pin Bar Candle Stick is small, representing the difference between the opening and closing prices during a specific trading period. This small body signifies uncertainty or indecision in the market.

Long Wick: The most distinctive feature of a Pin Bar Candle Stick is its long wick, which extends either above or below the body. The long wick indicates a sharp and sudden reversal in price during the trading period. It symbolizes a strong rejection of a particular price level.

Rejection: The presence of a long wick shows that the market initially attempted to move in one direction but was quickly pushed back in the opposite direction. This rejection suggests that the prevailing sentiment might change, making it a valuable signal for traders.

In essence, a Pin Bar Candle Stick acts as a visual representation of a battle between buyers and sellers, with the long wick indicating which side won. When the wick is longer on one side, it suggests that either buyers or sellers are gaining the upper hand, potentially leading to a trend reversal.

Table of Contents

Types of Pin Bar Candle Sticks:

Pin Bars Candle Stick come in several variations, each with its own unique characteristics and implications for traders. Understanding these types is essential for interpreting their signals accurately. Here are the primary types below,

Bullish Pin Bar Candle Stick:

A bullish Pin Bar has a small body Appearance at the bottom of the candlestick with a long upward wick.

Significance It signals a potential bullish reversal. This pattern forms when sellers initially push the price lower, but buyers regain control and push the price higher, closing near the session’s high.

Bearish Pin Bar Candle Stick:

A bearish Pin Bar features a small body Appearance at the top of the candlestick with a long downward wick.

It suggests a possible bearish Significance reversal. This pattern occurs when buyers initially drive the price higher, but sellers take charge and push the price lower, closing near the session’s low.

Long-Tailed Pin Bar:

A long-tailed Pin Bar has Appearance an extended wick on either the top or bottom, indicating a strong rejection of a specific price level.

This type of Pin Bar is often seen as a powerful signal of potential market Significance reversal due to the significant price rejection.

Differentiating between these types is crucial, as they provide valuable insights into the market sentiment and potential future price movements.

How to Spot a Pin Bar Pattern

Recognizing a Pin Bar pattern amidst various candlestick formations is a fundamental skill for traders.

Look for a Small Body:

A Pin Bar’s body should be relatively small compared to the length of the wick. The body represents the price difference between the open and close for that trading period.

Check for a Long Wick:

The defining characteristic of a Pin Bar is the extended wick, either above or below the body, indicating strong rejection at a specific price level.

Evaluate the Location:

Pin Bars are most effective when they form at key support or resistance levels. Their significance increases when they align with broader market trends. Traders should consider the context in which the Pin Bar appears.

Spotting a Pin Bar Candle Stick is the first step to harnessing its potential for trading decisions.

How to Trade With Pin Bars

Trading with Pin Bars Candle Stick requires a systematic approach to maximize their effectiveness. Here’s how to trade with Pin Bars.

Confirm the Pin Bar:

Before entering a trade based on a Pin Bar pattern, ensure that the pattern is clear and well-defined. Avoid trading on vague or uncertain signals.

Set Stop-Loss and Take-Profit Levels:

To manage risk effectively, determine your risk tolerance and establish appropriate stop-loss and take-profit levels. This step will protect your Capital to loss incase strategy failed by stop it minimize risk else this crucial to protect your capital.

Observe the Trend:

Consider the prevailing market trend. Pin Bars that align with the trend often have a higher probability of success. Trading with the trend reduces the likelihood of false signals.

Execute the Trade:

Once all criteria align, execute your trade based on the Pin Bar’s Candle Stick signal. Ensure you adhere to your predetermined risk management strategy.

Trading with Pin Bars can be a valuable strategy when done correctly, but it requires discipline and adherence to risk management principles.

Pin Bar Trading Strategies

Traders employ various strategies involving Pin Bars to enhance their decision-making process. Here are two common strategies.

Inside Bar-Pin Bar Combo:

This strategy combines the Pin Bar with an Inside Bar pattern. An Inside Bar forms within the high and low of the previous candle, indicating consolidation before a potential breakout. When an Inside Bar is followed by a Pin Bar, it can signal a strong reversal or breakout.

Engulfing Pattern Confirmation:

Traders use an engulfing candlestick pattern to confirm the Pin Bar signal. An engulfing pattern occurs when one candle completely engulfs the previous one, indicating a shift in market sentiment that supports the Pin Bar’s signal.

These strategies provide traders with additional tools to increase the accuracy of their trades when using Pin Bars.

Pin Bar vs. Doji

Comparing Pin Bars with another common candlestick pattern, the Doji, offers valuable insights into their differences and applications:

Pin Bar: Emphasizes price rejection with its long wick, indicating a sharp reversal. It suggests a strong shift in market sentiment at a specific price level.

Doji: Represents market indecision with its small body and equal opening and closing prices. A Doji can suggest a potential reversal or continuation, depending on the market context and the Doji’s location in a trend.

Understanding these distinctions helps traders choose the most appropriate pattern for their specific trading scenarios.

Comprehending the strengths and weaknesses of the Pin Bar pattern is essential for effective trading. Here’s a detailed look at its advantages and limitations:

Pin Bar Candle Stick Advantages:

Clear Reversal Signals: Pin Bars offer visually identifiable reversal signals on price charts, making them accessible even to novice traders.

Compatibility with Technical Analysis Tools: They can be effectively used in conjunction with other technical analysis tools and indicators to enhance trading decisions.

Effective at Key Support and Resistance Levels: Pin Bars are particularly potent when they form at significant support or resistance levels, providing strong signals for potential reversals.

Pin Bar Candle Stick Limitations:

False Signals in Choppy Markets: In choppy or ranging markets, Pin Bars can produce false signals, leading to unprofitable trades.

Confirmation Is Essential: Relying solely on Pin Bars for trading decisions can be risky. Traders should always seek confirmation in different ways strategies from other indicators or Patterns.

Success Depends on Risk Management: While Pin Bars can provide valuable signals, their effectiveness hinges on proper risk management practices. Traders should not overlook the importance of setting stop-loss and take-profit levels.

The Bottom Line:

In summary, the Pin Bar Candle Stick pattern is a powerful tool in the arsenal of technical analysis for traders. It offers clear signals of potential trend reversals and can be applied across various financial markets.

However, traders should exercise caution, employ risk management strategies, and consider the broader market context when incorporating Pin Bars Candle Stick into their trading strategies.

To trade using Pin Bars effectively, it’s essential to study and practice their application, understand market context, and continually improve your trading skills through education and experience.

Pin Bars are identified by their distinct appearance on price charts. Look for a small body and a long tail or shadow that stands out from the surrounding candles.

Pin Bars can be reliable indicators when used correctly and in the right context. However, they should not be the sole basis for trading decisions and should be confirmed by other factors.

Yes, Pin Bars can be used in various timeframes, from short-term intraday trading to long-term investing, depending on a trader’s strategy and goals.

Yes, Pin Bars can be applied to various financial markets, including forex, stocks, commodities, and cryptocurrencies.